Summary: Fintech app development and modern financial software development have changed how we handle money. By using APIs, cloud platforms, and strong security, fintech solutions deliver faster, cheaper, and more accessible services. Real examples also show the immediate benefits. Challenges remain (regulation, legacy systems, fraud), but pragmatic engineering and early compliance collaboration solve most issues. […]

Explore More

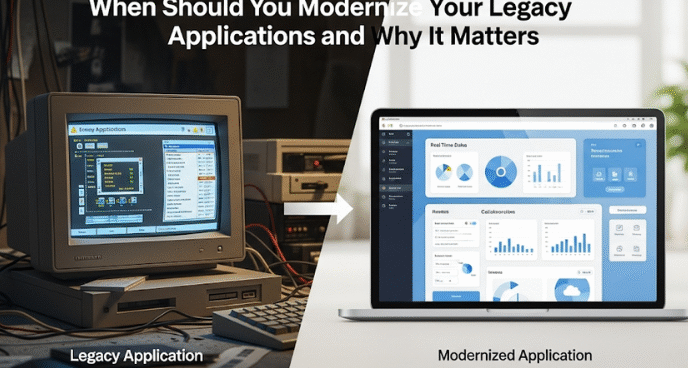

Summary: Are your legacy systems holding your business back? Here’s everything you need to know about when and why to modernize your outdated applications. It has become difficult to run a business with software that was absolutely cutting-edge ten years ago. Back then, your company was flourishing really well and gave you a real competitive […]

Explore More

Every business wants one thing at its core, i.e., happy customers. But here’s the question: how do you actually keep those customers happy over the long term? Is it just about great products? Or is it about the way you manage every single interaction with them? That’s where a CRM system for business steps in. […]

Explore More

Technology is moving fast. Blink, and there’s a new app, tool, or service changing the way we live and work. One of the biggest innovative paradigms is SaaS application development.Don’t stress about the technical term. It simply refers to creating software that runs online. No downloads or complex installations. You log in and start using […]

Explore More

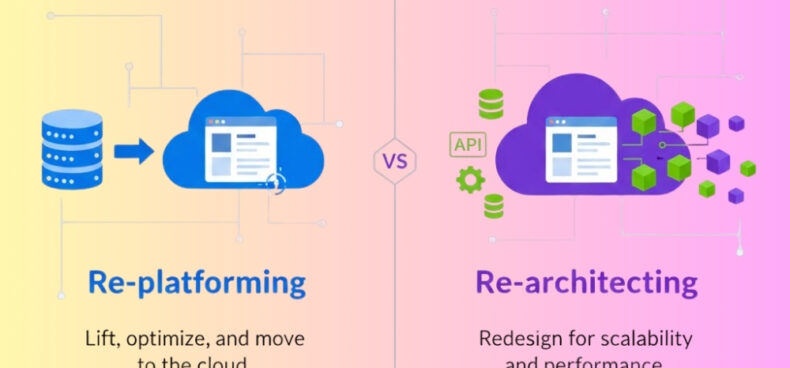

Modernizing legacy software isn’t just a technical update—it’s a business imperative for any organization aiming to stay competitive, secure, and agile in today’s digital economy. Legacy systems often slow innovation, increase maintenance costs, and expose companies to security and compliance risks. Two core modernization paths dominate enterprise strategies today: replatforming and rearchitecting. Both aim to […]

Explore More

Legacy systems don’t fail overnight—they quietly drain resources, slow innovation, and increase security risk. What once powered your business efficiently now limits scalability, delays product releases, and inflates maintenance costs. For leadership teams, legacy modernization isn’t just a technical upgrade. It’s a financial and strategic decision. Organizations modernizing legacy systems report reduced operational costs, improved […]

Explore More

Imagine you are a juggler, and you are juggling multiple balls at the same time. That’s what neobanking feels like today. You are managing payments, savings, investments, and budgeting, all in one seamless flow. And you know what’s the best part? You’re not at a risk of dropping the ball either because millions of people […]

Explore More

Open banking APIs are like a digital bridge connecting banks, fintechs, and businesses, so that they can easily and securely transfer financial data. Instead of having customers log in through a portal, apps have the ability to pull account data, initiate payments, or even provide a smart budgeting tool in real-time. This is the reason […]

Explore More

Today, almost everything in finance is online. Banks run their systems digitally. Payments, account records, transactions, and even customer data all live on the internet. This convenience is powerful, but it comes with its own set of serious repercussions. When money moves online, so does theft. Now, rather than physically breaking into a bank vault, […]

Explore More