Top

Search

People also search for:

- Home

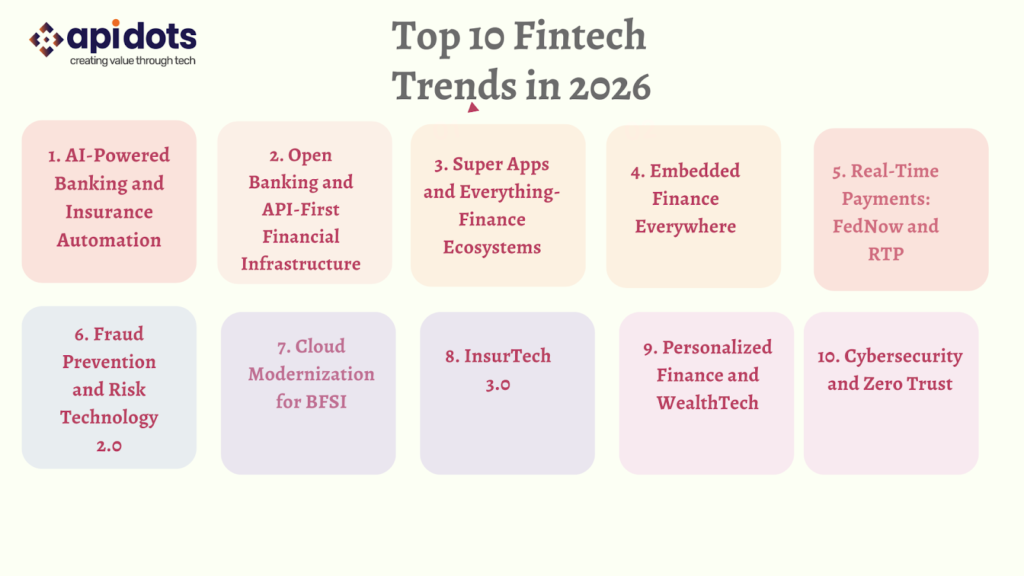

- Top 10 Fintech Trends in 2026: What Banks and Insurers Need to Know

Key Takeaways:

The U.S. financial services industry is undergoing its most significant digital transformation since the 2008 crisis. Consumer expectations have shifted permanently, AI is rewriting operations, Open Banking is redefining data exchange, and fraud is rising sharply.

Banks and insurers now face mounting pressure to modernize or risk falling behind fast-moving, digital-first competitors. 2026 is the year BFSI organizations must define a technology direction that will shape the next decade.

This guide explores the top 10 fintech trends in 2026, their impact on banks, insurers, and fintech platforms, where budgets are moving, and how organizations can build future-proof infrastructure for long-term growth.

For financial companies seeking actionable strategies, platforms like API DOTS demonstrate how technology partners can deliver secure, scalable fintech solutions.

Three primary forces define why 2026 is a turning point for banks, insurers, and fintech innovators.

First, technology is advancing faster than regulation can keep pace. Generative AI, real-time payments via FedNow, and automated underwriting systems are evolving more rapidly than compliance frameworks, creating both opportunities and risks.

Second, customer expectations have permanently shifted. American consumers now expect near-instant approvals, zero-friction onboarding, 24/7 support, transparent pricing, and personalized financial products.

Third, competition is no longer confined to traditional players. Big Tech companies like Apple, Google, and Amazon are offering financial products, fintech super apps are entering every niche, and embedded finance solutions are proliferating.

Success in the next decade will belong to institutions that combine trust, speed, and cutting-edge technology.

Artificial intelligence is no longer a futuristic concept—it is standard in credit underwriting, fraud detection, claims processing, personalized financial advice, and customer engagement. Banks benefit from AI by reducing underwriting times by up to 70%, manual claim processing by 60%, and call center operational costs by 50%.

Insurers leverage AI for claims triage, KYC/KYB verification, medical document extraction, and risk assessment. AI-driven systems generate predictive insights that empower teams to make faster, data-backed decisions, ensuring accuracy, efficiency, and cost savings.

Companies can implement AI-powered chatbots, automated document extraction, claims automation workflows, and personalized advisory engines to remain competitive.

Open Banking adoption is expanding rapidly in the U.S., with platforms such as Plaid, MX, Finicity, and Akoya enabling secure, real-time data sharing among banks, fintech apps, insurers, and consumers.

Customers expect instant connectivity between accounts, investments, payroll, credit, and insurance data. For banks, open banking transforms traditional operations into platform-based models that facilitate automated lending, identity verification, holistic financial management, and faster merchant onboarding.

Fintech founders can build innovative apps without developing the underlying banking infrastructure. Insurers gain enhanced fraud scoring through unified financial data.

Custom API-first solutions, such as those built by API DOTS, empower organizations to integrate open banking seamlessly, enabling unified dashboards, aggregated financial insights, and flexible development for new services.

Global leaders like Nubank and Revolut inspire U.S. fintechs to create super apps that consolidate banking, payments, investments, credit, insurance, lifestyle services, and rewards into a single mobile-first ecosystem.

Consumers no longer want to juggle multiple apps; they expect all services to be on one platform. Banks see super apps as a way to increase wallet share, boost customer retention, and generate recurring revenue.

Developing modular architectures enables rapid addition of new features, plug-and-play insurance and investment modules, and seamless service expansion.

Embedded finance has redefined how non-financial companies offer financial products. From Uber issuing credit cards to Shopify providing loans, embedded payments, lending, insurance, and investment products are now integrated into everyday platforms.

For banks and insurers, embedded finance opens access to millions of consumers via partner ecosystems. Companies can implement white-label finance modules, partner onboarding systems, payment and lending rails, and API-driven insurance distribution to expand reach without building infrastructure from scratch.

The launch of FedNow and increased adoption of RTP (Real-Time Payments via The Clearing House) are changing the speed of transactions. Banks now offer instant payroll, consumer disbursements, merchant settlements, and insurance claim payouts.

Insurers can improve trust and reduce fraud by disbursing claims instantly. Companies are investing in integrating FedNow and RTP rails into their platforms to support real-time financial operations and elevate customer experience.

Fraud has increased by more than 230% over five years. Modern fraud prevention relies on device fingerprinting, behavioral biometrics, AI-driven risk scoring, geo-risk detection, IP reputation, and real-time alerts.

Financial institutions must implement ML-driven monitoring systems, KYC/AML automation, and layered device-risk detection to prevent account takeovers, social engineering, synthetic identities, and payment fraud.

Legacy IT systems are a bottleneck for innovation. Banks and insurers are migrating to AWS FSx, Azure Confidential Computing, and GCP Banking Data Storage to achieve scalability, enhanced security, real-time analytics, and faster product launches.

Cloud modernization allows companies to implement microservices architectures, containerized fintech solutions, and digital core banking layers, lowering infrastructure costs while increasing operational efficiency.

Insurance companies are adopting AI-based underwriting, IoT risk scoring, instant claim payouts, embedded insurance partnerships, and self-service portals. Custom solutions include automated claim platforms, AI document scanning for claims, digital underwriting engines, and IoT dashboards.

These innovations reduce processing times, enhance customer engagement, and improve risk assessment.

Consumers expect tailored investment plans, credit options, tax recommendations, and insurance advice. Powered by AI, Open Banking, behavioral insights, and transaction analysis, financial institutions can deliver highly personalized services.

Wealth management apps, AI financial advisors, retirement planning dashboards, and portfolio rebalancing systems provide unique value and improve client retention.

Security is critical in an era of rising breaches. Banks and insurers adopt zero-trust architecture, MFA, biometrics, API security, encrypted data lakes, and insider threat monitoring. Implementing zero-trust infrastructure, highly secure mobile apps, and PCI/SOC 2-compliant systems ensures that sensitive financial data remains safe while enabling operational agility.

Digital-first neobanks are rapidly expanding by targeting niche segments, including immigrant banking, teen banking, gig workers, and SMBs. These banks and micro-insurers address gaps that traditional institutions ignore.

Development involves neobank apps, onboarding systems, card issuing platforms, core banking integrations, and loan management software. These platforms enable targeted solutions that capture market share quickly.

Banks must modernize legacy systems, adopt Open Banking, integrate real-time payments, leverage AI for risk and fraud, and deliver faster digital experiences. Insurers need digitized claims processes, automated underwriting, expansion of embedded finance, and AI-driven decisioning.

Fintech startups must prioritize secure, compliant platforms, instant banking data integrations, and personalized services to stand out in a competitive market.

Banks must modernize legacy systems, adopt Open Banking, integrate real-time payments, leverage AI for risk and fraud, and build fast digital experiences. Insurers need digitized claims, automation, embedded insurance, and AI-driven underwriting.

Fintech startups should build secure platforms, integrate banking data, and differentiate through personalization.

Organizations leveraging these trends gain a competitive edge, operational efficiency, and stronger customer trust.

Fintech development requires specialized expertise in compliance, security, Open Banking APIs, insurance data models, payment rails, complex workflows, and KYC/AML processes. Leading partners deliver web and mobile fintech development, neobank architecture, insurance platforms, lending automation, AI risk scoring engines, and compliance-ready infrastructure.

Strategic partnerships turn trends into revenue-generating products, ensuring your organization stays ahead of competitors in 2025 and beyond.

The U.S. BFSI sector is at a decisive moment. Institutions investing in AI, automation, secure infrastructure, open banking, real-time payments, embedded finance, and superior customer experience will dominate the next decade. Those who wait risk losing relevance to agile, tech-savvy competitors.

Banks, insurers, and fintech innovators must modernize now with the right technology partners. By adopting secure, API-driven platforms and leveraging advanced fintech tools, organizations can future-proof operations and capture market share in the digital-first era.

Platforms like APIDOTS demonstrate how BFSI companies can efficiently implement secure, API-first fintech solutions.

We develop compliant fintech and digital banking solutions.Designed for security, performance, and regulatory confidence.

View BFSI Solutions

As a technology-driven web designer specializing in healthcare solutions, I create digital experiences that bridge the gap between medical professionals and modern patient expectations. With a strong focus on usability, interoperability, and future-ready interfaces, I design platforms that simplify clinical workflows, improve patient engagement, and support secure, data-driven healthcare ecosystems. My work blends clean UI/UX with practical healthcare insight, helping hospitals, clinics, and healthtech startups adopt smarter, more efficient, and patient-centric digital solutions.